Explain Different Types of Bill of Exchange

Trade Draft When the individual issues the bill it is known as trade draft. Demand Bill - It is a bill that must be paid when it is demanded.

Difference Between Bill Of Exchange And Promissory Note With Comparison Chart Key Differences

The issuing bank guarantees payment on the transaction.

. Different types of bill of exchange. Time Bill of Exchange Sight Bill of Exchange A sight bill of exchange must be paid once the is presented to the draweebuyer whereas the time bill of exchange must be paid once the fixed time of the bill has lapsed. To make an instrument of value the drawee must accept it.

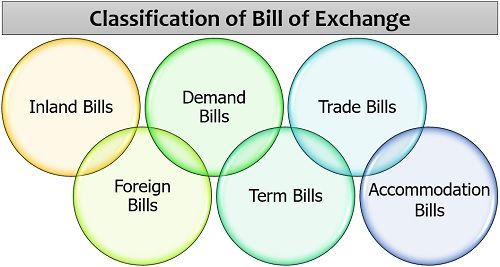

Different Types Of Bill Of Exchange Based on the requirement and mode of payment different types of bills of exchange are used. Now that you have a better understanding of what a BOE is here is a breakdown of the various types of bills of exchange. Here is the list of types of bills of exchange.

Bank Draft When the bank of exchange is generated or issued by the bank it is termed a bank draft. They are payable at any. The payee can ask for the bill of exchange and can receive his money using a bill of exchange from the legal party involved in the transaction.

The different parts of the Bills of Exchange are. Explain the different types of bill of exchange. The instrument is addressed to the buyer.

Inland bill means the bill which is. Read more that contain an order to pay a certain amount to a particular person within a stipulated period of time. The amount must be payable either to a certain person or to his order or to the bearer of the bills of exchange.

A bill of exchange is a written and unconditional order issued by the drawer the seller of goodsservices and addressed to the drawee the buyer to pay a certain sum either immediately a sight bill or on a fixed date a term bill to a specified person usually the drawer himself or to the bearer of the bill. What Are the Various Types of Bills of Exchange. Drawer of the bill.

TYPES OF BILLS OF EXCHANGE As shown in the above image Bills of Exchange are normally of two types. Demand Bill- This bill is payable when it demanded. The person who holds the bill and is entitled to realise the amount of the bill from the drawee is known as holder of the bill.

There are four parties involved in the process of payment through bill of exchange. Understand discounting endorsing dishonor renewal and retiring of the bills. A bill of exchange includes what items are being shipped and how many are in the order an invoice requesting payment and details about when the payment is due and often bank information to fulfill.

A bill of exchange an instrument in writing. 5 Bill of exchange is unconditional. It is drawn on a specific person ie.

Types of Bill of Exchange on the Basis of Period. Tem Bills of Exchange. There are three entities that may be involved with a bill of exchange transaction.

It includes bills of exchange delivery order promissory note customer receipt etc. Documentary Bill-The Bill of Exchange is accompanied by the required documentation that attests to the validity of the sale or transaction between the seller and the buyer. Types of Bill of Exchange Documentary Bill- In this the bill of exchange is supported by the relevant documents that confirm the genuineness of sale or transaction that took place between the seller and buyer.

Demand Bills of Exchange. There are many forms of bill of exchange but the main ones are. The bill of exchange is unconditional that means the drawee of the bill of exchange is bound to pay the money once he gets the services which are mentioned in the bill.

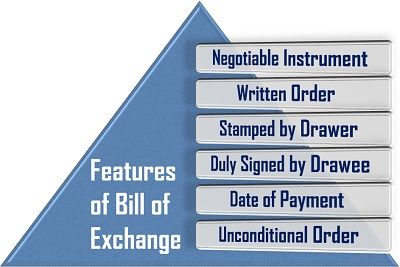

The following are the features of bills of exchange. Contains an unconditional order to a person ie. It is drawn and signed by the maker ie.

Define and explain the accounting treatment of accommodation bill. This party requires the drawee to pay a third party or the drawer can be paid by the drawee. The bill of exchange is issued by the creditor to the debtor when the debtor owes money for goods or services.

Bills of exchange can be based on period as demand bills and term bills. It is the party who sells the goods issues the bill of exchange and is yet to receive the money from the debtor. What Are the Different Types of Bills of Exchange.

They are as follows. There is no fixed date for the payment of such bill. On the basis of period bills are of two types.

Because there is no set payment date for the bill it must be cleared whenever it is delivered. A bill of exchange issued by a bank is referred to as a bank draft. All the procedures involved in foreign trade regarding purchase and sale of goods are to be followed.

Bills may be of the following types. The date of payment should be certain. Bills of Exchange Payable at Sight These types of bills are payable on demand and the drawee has to pay the amount when the bill is presented to him for payment.

It should be paid either on the expiry of a fixed period of time or on demand. The Seller of goods who writes the Bills of Exchange. Bills of Exchange Payable After a Certain Period of Time.

Define and explain a. The buyer must pay the Seller on demand a sight draft or at a fixed determinable time in the future also called time. This party pays the amount stated on the bill of exchange to the payee.

Expect some cases will explain further. A bill of exchange is an instrument in writing containing an unconditional order signed by the maker directing a certain person to pay a certain sum of money only to or to the order of a certain person or the bearer of the instrument. There are four different types of.

They become payable at ay time when they are presented before payee by the holder. Explain the accounting treatment of bills of exchange. It is the party who purchases the goods on credit and to whom the bill of exchange is issued.

First of all the bill is written. Basically drawee is the debtor and the drawer is. Demand bills do not have a fixed date associated with them.

Drawee to pay the specified amount. Bill of exchange must be signed by its maker.

Bill Of Exchange Vs Promissory Note Difference And Comparison The Investors Book

Bill Of Exchange Vs Promissory Note Difference And Comparison The Investors Book

Bill Of Exchange 11 Types Of Boe Explained With Meanings Examples

No comments for "Explain Different Types of Bill of Exchange"

Post a Comment